Single Marine Program

The Single Marine Program (SMP) serves as the voice for single Marines in identifying concerns, d...

Military Family Life

Military & Family Life Counselors (MFLCs) are experienced behavioral health professionals who wor...

Child and Youth

Child and Youth Programs (CYP) provide high quality child care programs and services that support...

Prevention and Counseling

Using an integrated community health approach, the Community Counseling Program (CCP) equips Mari...

Personal Financial Management

The Personal Financial Management Program assists Marines and their families in achieving and sus...

Volunteer Opportunities

The Volunteer Program provides volunteer opportunities to active duty personnel, their family mem...

Transition Readiness Program

The Transition Readiness Program implements a comprehensive transition and employment assistance ...

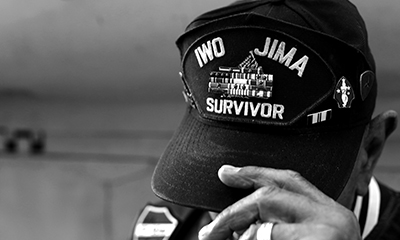

Retired Affairs

Honor and provide quality service for retirees, veterans, military family members and separating ...